Tax Certificate #Protips to Avoid Claims | Industry Articles

Any closer has seen hundreds of Tax Certificates. Seasoned closers have probably seen thousands. Tax Certificates have evolved over the years from a hand typed legal sized hand signed Tax Certificate of the 90’s to the modern multi-colored PDF files we know today. What has not changed are the basics of any Tax Certificate; CAD information, Tax Bill information and notes. Today, I’ll share with you how I read a Tax Certificate and what I am looking for while I do.

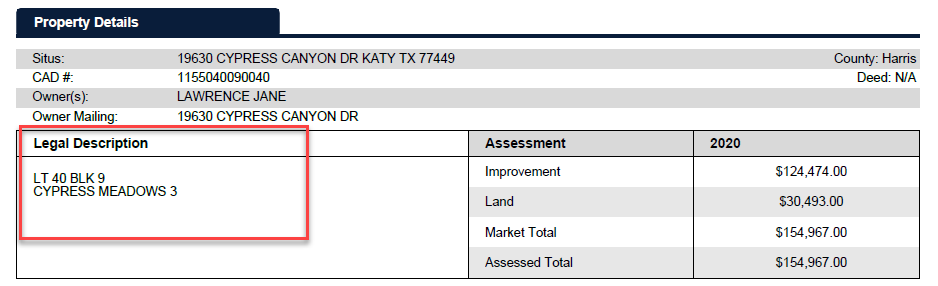

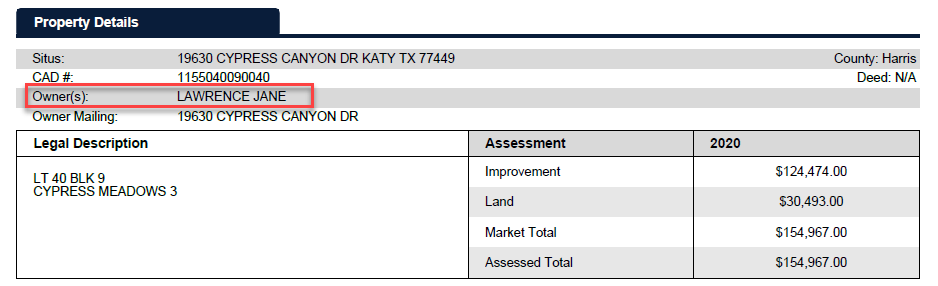

First stop, CAD information. The very first thing I look at on a Tax Certificate is the legal description. Does it match the order or commitment? Is there anything in the legal that raises a red flag like UDI (Undivided Interest which can mean additional owners), IMP ONLY (Is this a Mobile Home with no land meaning most likely it is Personal Property), AG or NON-AG (Is this only part of the property because the CAD split it into AG and NON-AG parcels for assessing)?

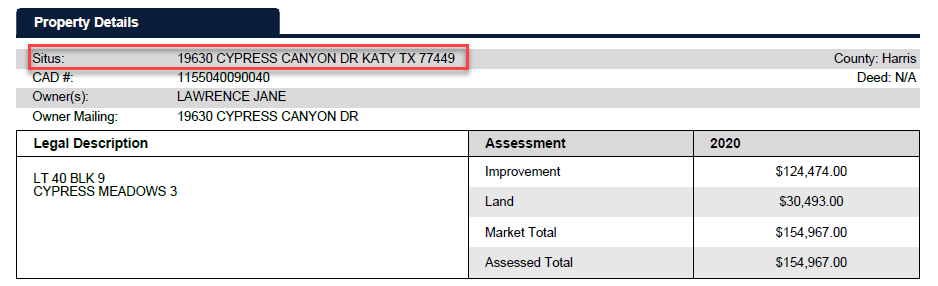

If everything matches and there are no red flags I move on to the address. Does the address match the order? Does the situs address match the mailing address? This is very important and cannot be understated. If the situs address does not match the mailing address that means the owner most likely does not live in the property. Further this means the owner would not be eligible for some of the standard exemptions like Homestead or Over 65. If the situs and mailing addresses do not match, I immediately move to the exemptions section and see if any exemptions are present. If there are exemptions present, then questions need to be asked to the seller regarding the property’s status.

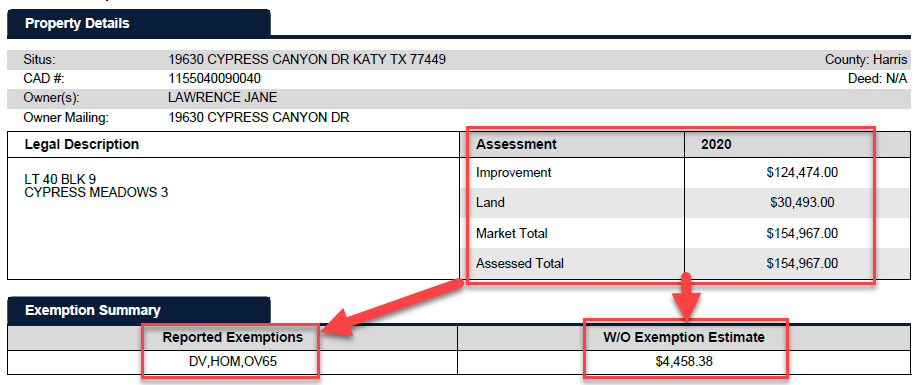

Next for review is the value section. Is there an improvement, should there be? Does the property have an AG exemption? While looking at the value of the property now is when I will look at the WOE (Without Exemption Estimate). The WOE is a calculation of the tax rates (combined) times the Market Value. Is the WOE Estimate higher than the tax summary or is it exactly the same as the summary? If the WOE is higher, I would expect to see at least one exemption in the exemption summary. If it is exactly the same (or a penny off) then I would expect to see no exemptions present. If the WOE is higher than the tax summary and no exemptions are present you should contact your Tax Certificate provider as something is off.

Now I am looking at the owner name. Is it a person or a company? Is it the seller? Is it a person’s name but has Living Trust? If it is a person that is usually enough for my review. Closers will want to make sure the owner and seller match. There are times where sales have happened fairly recently, and the CAD will still show the previous owner because CADs are always working one year behind. If the owner is a company, are there any exemptions that a company would not qualify for such as a Homestead or Over 65. More red flags to watch for.

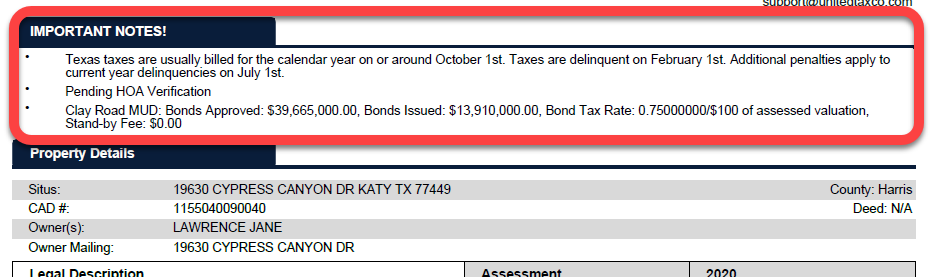

Now that I have reviewed the CAD information I look to see if there are any notes or comments on the Tax Certificate. Notes from Tax Certificate providers can be found usually near the top of the certificate but can sometimes be found within the body or at the end. It is important to know what kind of comments your provider puts on a Tax Certificate and where. Notes can be important if you deal with builders and the lot and block you requested is new for the next tax year. The provider will usually put the lot and block you requested in the notes “ordered as lot 2 block 3 of River Canyon Estates – new for 2022”. Other things you might find in notes include tax suit information, value information that is non-standard (property’s value is in dispute or ARB) or if your property is acreage and was worked by metes and bounds there will be a note about “requested 48.337 acres – reported 92.11 acres”. These are all important comments that should be reviewed and understood to make sure they are accurate for your transaction.

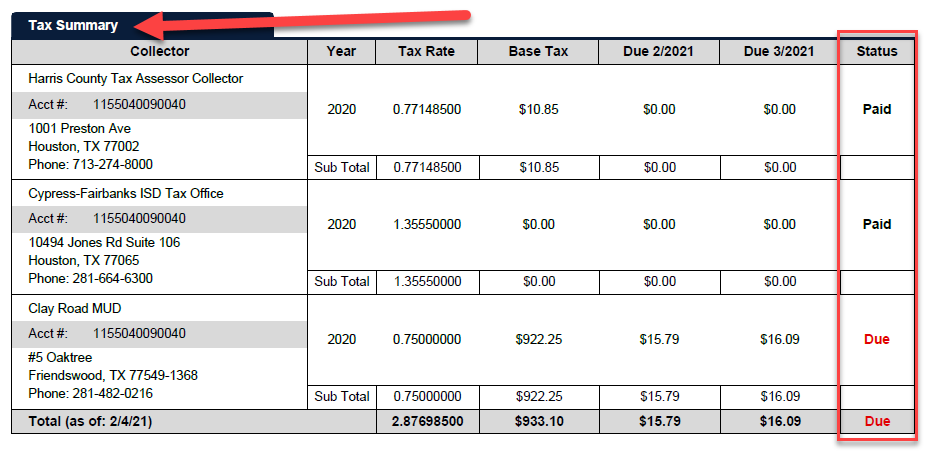

Finally, I quickly review the tax bills section. Are all the bills or entities the same status meaning are they all paid or all due. It is not typical that you see only one entity that is paid while the other are due or vice versa. This would be a red flag for me. Again, I am checking the billed amounts against the WOE Estimates. Are they the same? There should be no exemptions. Are they less? Exemptions should be present. Are they higher? Contact your Tax Certificate provider.

I hope this walkthrough has been helpful for you and maybe given you some additional things to look for when reading a Tax Certificate. Something you would like to add? Have a burning question you have always wanted to ask about Tax Certificates? Drop me a line at [email protected] anytime!