Buying a home can be a whirlwind. Most homebuyers are focused on the inspection report, their loan approval and mortgage paperwork, not to mention planning their move and the sale of their old home. With so many different items vying for the attention of the buyer, it’s easy to let the title commitment rest on the back burner. However, just as no two snowflakes are the same, neither are title commitments, and they may even have different names based on where you live, like binder or prelim report. For this month’s installment of Title 101, we will review and explain the main parts of the title commitment and how to avoid surprises after closing.

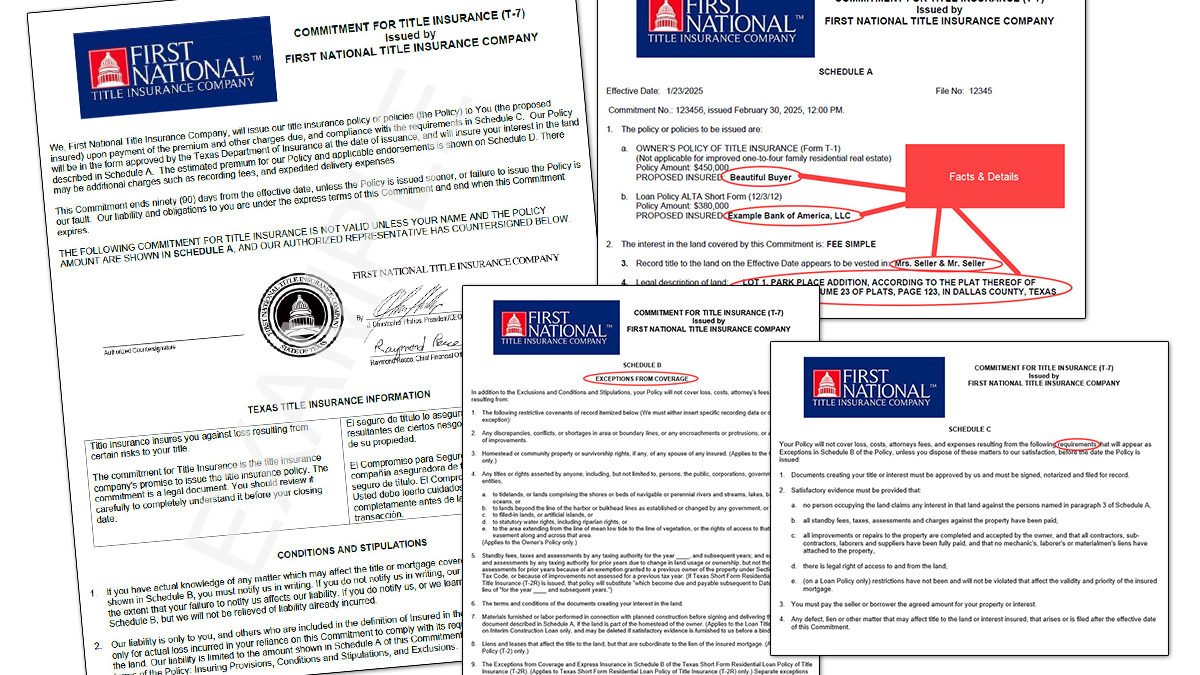

A title commitment is essentially just a promise to issue a title insurance policy. It is created by either a title company or a law firm that specializes in real estate. It will outline and document the required steps for the title company employee to cure defects and deliver a free and clear title to the buyers. The way this outline is determined is with a title search, and based on what they find, they create the commitment. It also discloses information about the title company, and the property itself.

To help provide some clarity, we will go over an example. Jack and Jill are in the market for a house. They put in an offer, which is then accepted, and the real estate agent starts a file with a local title company. The title company will immediately begin a title search. The title search comes back clean except for some delinquent property taxes owed. The title commitment would then outline, among other things, that as long as the property taxes are brought current prior to closing, the policy will be issued. At closing, since all issues have been addressed, the commitment executes, and the policy is issued. The commitment does not promise that no issues will ever arise, but it does promise to issue insurance to cover any issues that may. There are of course many other parts of the title commitment, so let’s get an idea of each one.

In most states, a title commitment has four main parts, called schedules. Each schedule describes specific details of the property, including ownership, liens, burdens, defects, and obligations. A helpful acronym to remember what each section defines is the ABC’s of title commitment.

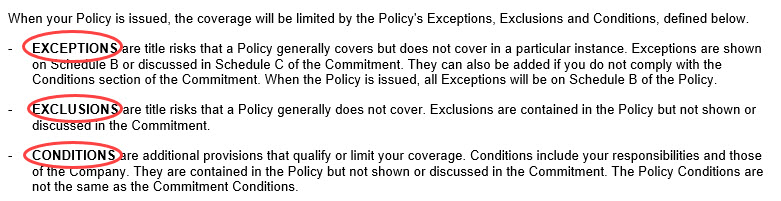

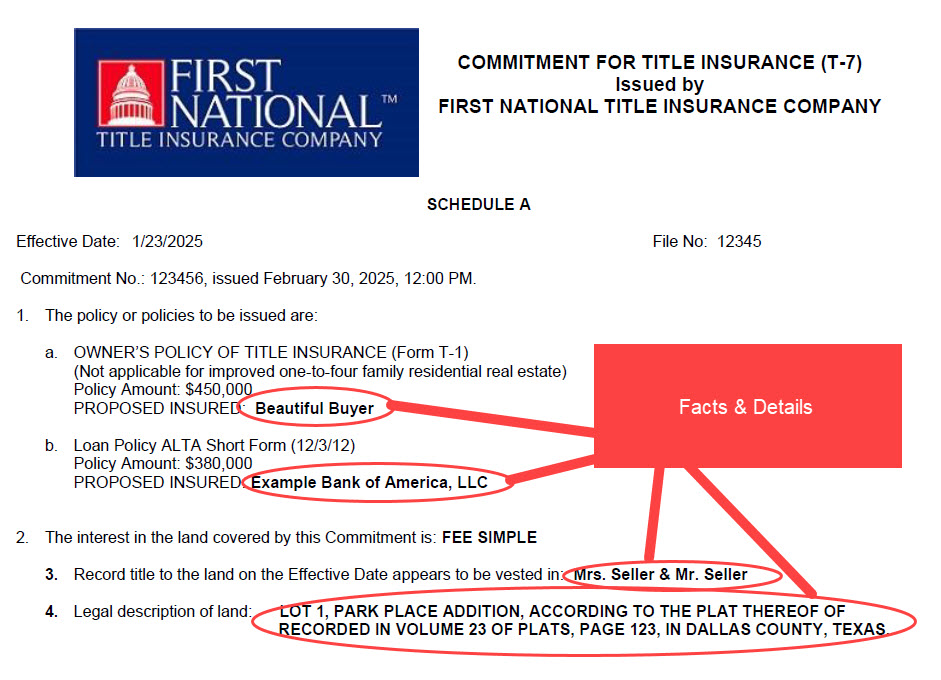

Schedule A: Actual Facts

The first of the four schedules give the name of the buyer and seller, the legal description of the parcel, the sales price, and the name of the lender.

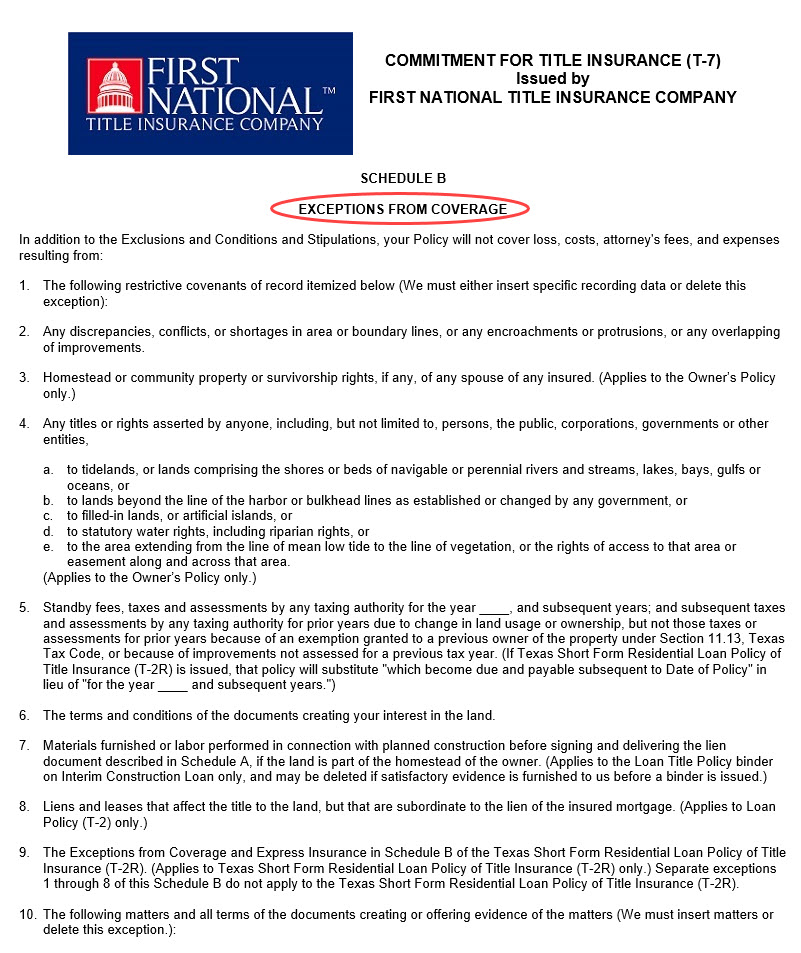

Schedule B: Buyer Notification

Next up is the list of notifications or exceptions on the property. It will list any easements, mineral/water rights, survey notes, taxes, and setback lines. It can potentially also outline any number of items that will be excluded from the policy, and therefore the buyer must be notified about.

Schedule C: Clear to Close

The third schedule will have very specific instruction on any items or issues with the title that must be resolved prior to sale or transfer. The most common item here is the payoff of the current mortgage. Other common items are unpaid property taxes, any liens for construction, and even HOA fines/dues. Every item in this section must be reviewed and resolved before the property can close and the policy and be issued.

Schedule D: Disclosure

The final schedule is a notification of all the parties who will take part of the policy premium, and also the ownership of the title company who sold the policy. This list will host a bevy of names including the underwriter, title agents, attorneys, and others.

When looking at a commitment without an understanding of what each section is designed to outline, it can be easy to be overwhelmed. Most buyers spend little time reviewing this document, but the benefit of achieving a better understanding of what you’re actually buying, as well as the limits of what you can do and what you truly own, is priceless. Next time you’re buying a piece of property, take a moment to see the whole picture.