What is the Property Tax Relief Act?

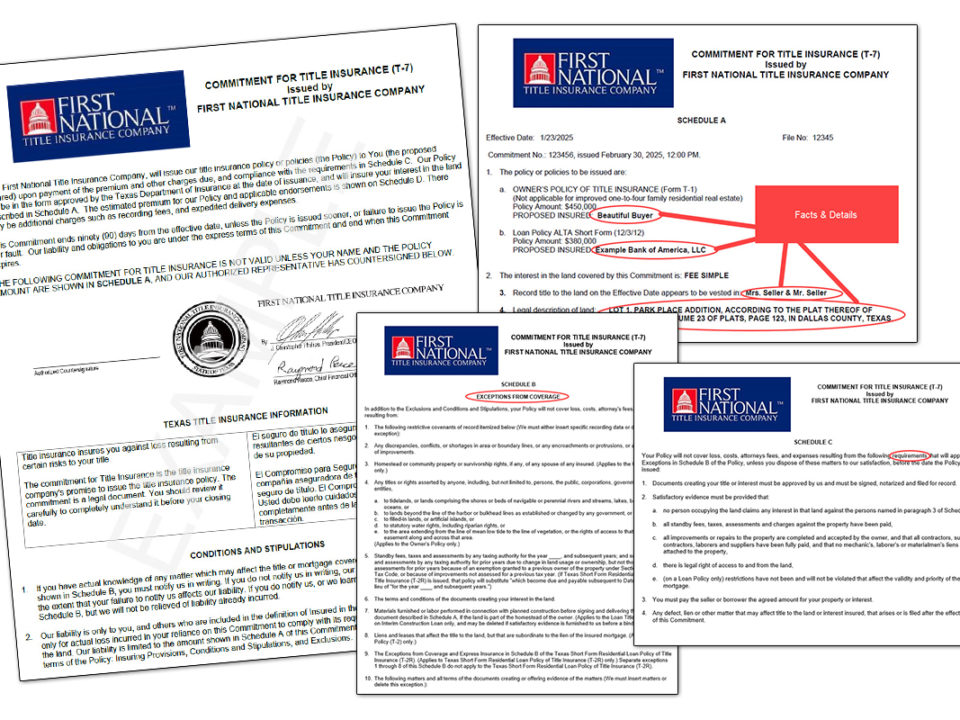

The Property Tax Relief Act consists of two main parts:

1) The increase of the Homestead Exemption for all ISDs across Texas from $40,000 to $100,000 and

2) Compressing (decreasing) the tax rate of each Independent School District (ISD) by 10.7 cents per $100 dollars ($0.107/$100).

When will this happen?

This will not legally go into effect until it is passed by voters in the November 7th election. However, the bill is written in such a way that the school districts and counties have been instructed in Article 6 to send out tax bills as if the measure has already passed. This means property owners will see the lower tax liability on their property tax bills prior to the legislative vote.

How much will the tax bills be for the ISDs?

As prescribed in SB2 Article 6, the tax offices are instructed to create a provisional tax statement billing the tax amount as if the election passed and increased the exemption amount. The tax statement will also show you how much was saved and what a supplemental bill would be if the vote does not pass. The exact wording can be found here in Section 6.08 of SB00002I.

What does this mean?

For all intents and purposes, tax bills will be certified and released just like any other year. United Tax Services will utilize its industry leading robotic automation technology to provide the most current information as it becomes available on the county records repositories. You should not experience a disruption in services. We will continue to monitor the situation as it develops and provide additional guidance, if necessary.