Today we are going to be reviewing and explaining not only one of the most basic parts of the title closing process, but the riskiest. Tax certificates are simple but provide the information necessary to protect against the most common and financially damaging errors in the closing process. The ability to read and understand a tax certificate is critical to providing not just a timely close, but a safe one. So, let’s talk tax!

Last month we briefly explained what a tax certificate is, but let’s have a quick refresher. A tax certificate is a guaranteed and indemnified report of the current tax liability for the property. It gives additional information as well, such as owner information, currently applied tax exemptions, a brief description of the property itself, and a list of all the jurisdictional entities that have the right to tax it. Additionally, it may include information about delinquent taxes or lawsuits filed against the property if such issues exist. These certificates are essential in every transaction, not only to ensure the property won’t be subject to seizure due to delinquent taxes, but also to calculate escrow and prorate closing settlements.

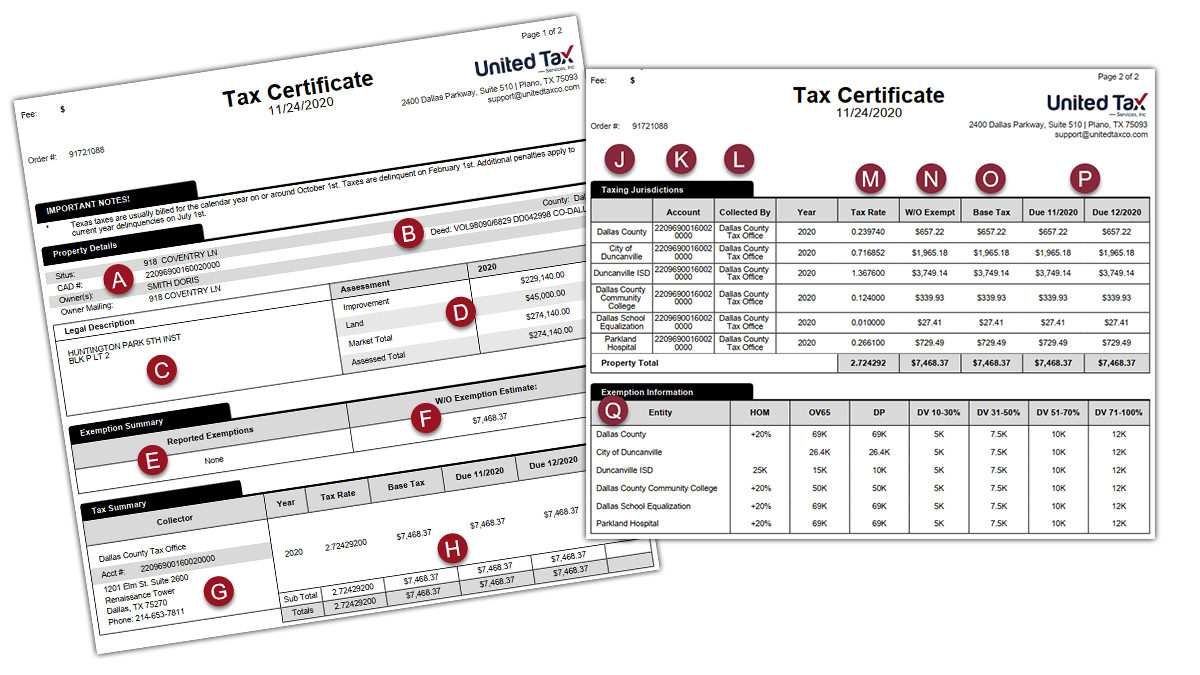

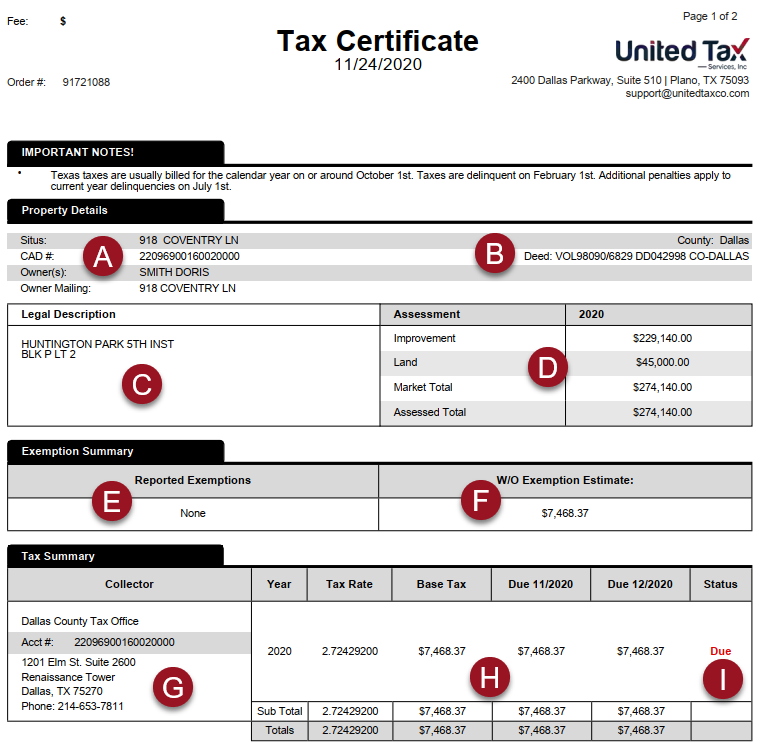

When you begin reviewing the tax certificate as part of your file, there truly is a best way to begin. It may seem obvious to check the Situs and Legal Address (See A and C below) first, but many will move straight to the reported tax amounts. Try your best not to fall into this habit, as property verification should be your first task on every piece of documentation from the tax cert to the title package. Once you have verified the property address and made sure your seller is the legal owner, or their representative, you are ready to move on.

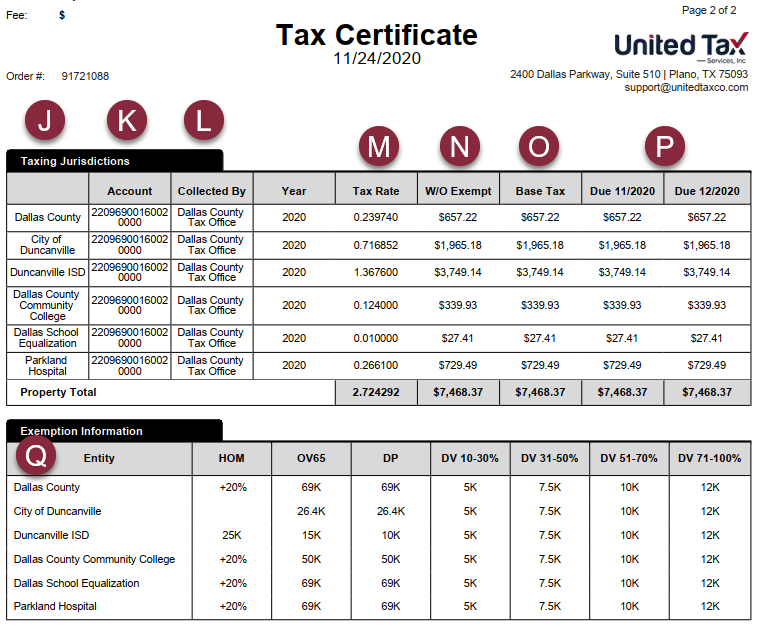

Here again, we want to resist the temptation to go straight to the tax reporting section. Although this is a tax certificate, there is other information that can be paramount to the tax data. The next section we want to review and verify is the place where most property tax claims stem from, the exemption data (See E above). The vast majority of homes hold some form of exemption, most commonly the Homestead exemption, but there can also be a selection of other exemption types. This is what I personally believe to be the most important item on your report, let’s talk about why.

Exemptions are always granted to the owner of the property, not to the property itself. The only exception to that is Agricultural Exemptions, which we will go over in a future article. What this means is that every time a property is sold, the exemptions that are reported by the county will be removed unless the new owners apply to have their exemptions transferred or activated. This is common practice, however, the important thing to remember is that those exemptions don’t stay automatically, they will always need to be applied for with the county. By treating every exemption this way, you can properly prorate your taxes based off a without exemption amount or instruct your buyers on the importance of applying for exemption transfer or eligibility.

Now, we are finally ready to move on to the actual tax amounts (See H & I above). If the amount shows as zero, you’re good to go. If taxes are due, you need to look further at if the account is current or not. In Texas, you will typically see taxes due on properties closing October – January and part of the closing proceeds will be used to pay those taxes. However, if you see taxes that are delinquent, further understanding is necessary. Use the certificate to determine how many years are past due, what type of penalties and interest are accumulating, has a suit been filed by the county or other entities yet. You need a clear understanding of each properties unique tax bill status to ensure your buyer isn’t surprised by a supplemental tax bill 6-24 months down the line.

We did it! With this mindset while reviewing and researching tax certificates, you can prepare yourself and your escrow team to guard against claims and supplemental tax bills. By using a straightforward and thorough review process which starts with basic property verification, progresses through exemption validation, and ends with tax review, your office is better protected. Take a few minutes to think about how you review a tax certificate, and how you can better serve your clients with better review habits.